Finally, a loan that's built for real life.

Life comes with change. Now, your loan can, too. Introducing the only loan with Take-Backs™.

A better way to borrow from Denali State Bank and Kasasa®.

Step One

Get a fixed rate from a local lender.

For your next car, vacation, or debt consolidation — you make the call.

- Fixed rates (because you deserve peace of mind)

- Fast, local decision-making and processing

- Friendly, attentive service from start to finish

Step Two

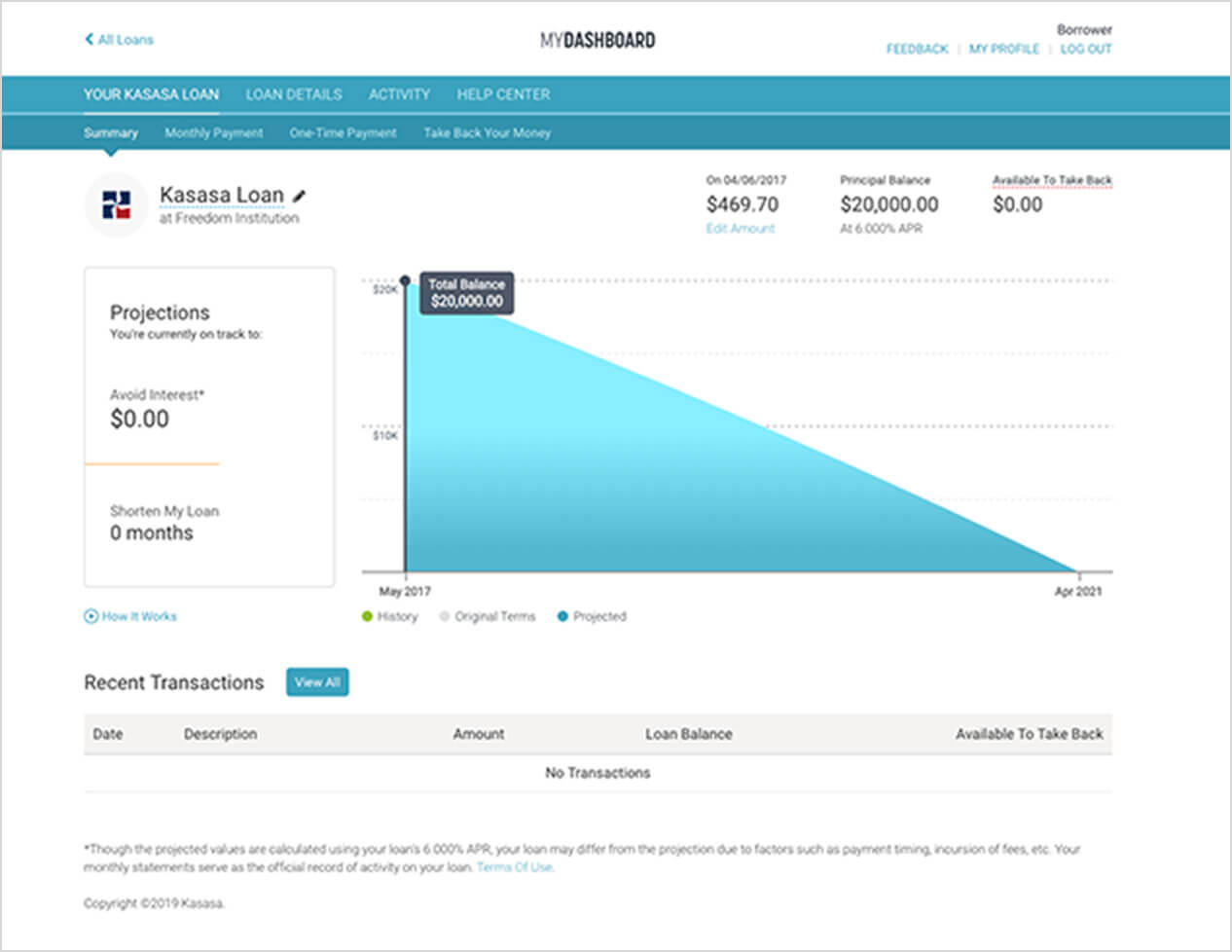

Get out of debt faster (and save on interest).

If you pay ahead on your loan, we'll shorten your term. So, you can cut this bill from your budget sooner. Changing your routine could free up funds for additional payments.

Step Three

Get a Take-Back® if you need it.

If you pay ahead on a regular loan, you can't get that money back. Ever. But what if something comes up? The Kasasa Loan® lets you access extra funds at any time. We call that a Take-Back®.

Step Four

Get ready to celebrate.

Less debt — more freedom. Use your money the way you want with the Kasasa Loan.

The Kasasa Loan is like any other loan, only better.

We kept what works. Like fixed interest rates that you can always count on. Then we added features to make your finances more flexible. It’s your money, after all.

Regular

Loan

Kasasa

Loan

The experts love this loan.

Get the loan that puts you first.

Take back banking® with the Kasasa Loan. Choose the kind of loan you need.